Colin Grabow

Last week I mentioned the use of bleak language by members of the commentariat to describe the state of US manufacturing, but I had no idea such a prime example of this mistaken rhetoric would present itself so quickly thereafter. Writing in the Wall Street Journal last week, Oren Cass called for raising tariffs to rescue an industrial base he described as “reeling.” But both Cass’s premise and prescribed remedy are badly flawed. United States manufacturing remains in robust health and new tariffs will only undermine the sector.

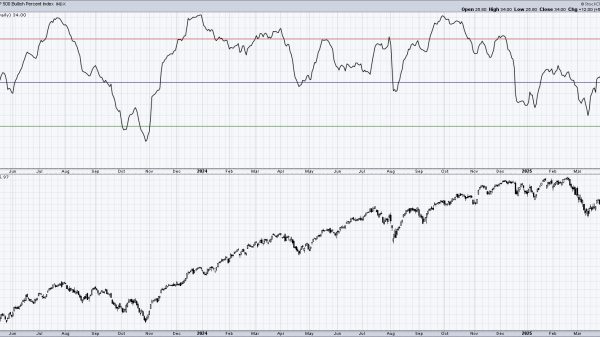

Although various metrics exist for assessing the state of manufacturing, perhaps the best one is output. The goal of manufacturing is production, so how much stuff is being produced? The answer, as I explained in a recent essay, is quite a lot. In fact, the sector’s output is currently only five percent off its all‐time high.

Other metrics painting an even rosier picture. In terms of real value‐added, the sector reached a record high last year.

And measured by value‐added per worker, U.S. manufacturing is significantly ahead of other advanced economies such as South Korea and stands head and shoulders above China.

Such productivity allows Americans to produce massive quantities of goods with fewer workers than in decades past. And the quantities produced are massive indeed. In 2019, US firms exported over $1.3 trillion in manufactured goods. This includes high‐tech products such as aerospace and aircraft parts ($60.1 billion), integrated circuits ($41.2 billion), and medical instruments ($29.4 billion).

The United Nations’ 2022 edition of its International Yearbook of Industrial Statistics found that the United States was the world’s third‐leading exporter of medium‐high and high‐technology manufactured goods.

United States manufacturing is not only deep but broad. Beyond high‐technology products, UN data show the United States is also a leading producer in numerous other areas, including paper and wood products, beverages, and coke and refined petroleum products. Of 23 manufacturing categories examined by the International Yearbook of Industrial Statistics, the United States was either the leading or second‐leading manufacturer in 21 of them.

And yet we are to believe that is an industrial base that is reeling?

Given such realities, Cass’s task of finding the data to portray US manufacturing as being under siege is a difficult one indeed. To marshal evidence for his case, the executive director of American Compass states the following:

Whereas real manufacturing output doubled from 1980 to 2000, it rose only 7% from 2000 to 2020. As a result, after holding steady for 50 years, manufacturing employment collapsed by one‐third, eliminating more than four million jobs. Automation is not the story here. To the contrary, manufacturing productivity has declined over the past decade—a shocking trend incompatible with a well‐functioning capitalist system—leaving the sector far less competitive.

The passage, however, is self‐refuting. If manufacturing output has steadily increased yet employment has fallen by a third, it defies credulity to claim that this is anything other than an automation story. How could it be otherwise?

Data further point toward the role of automation. From 2000 through 2010, manufacturing labor productivity increased by approximately 45 percent, while from 2010 to the present it dipped by just under 3 percent. In other words, manufacturing labor productivity is significantly higher today than at the turn of the millennium—exactly what one would expect given rising output and a notable decline in employment.

Little wonder a 2015 study found that productivity growth was responsible for 88 percent of manufacturing job losses in recent years.

Furthermore, the modest decrease in productivity since 2010 has correlated—not surprisingly—with an increase in manufacturing employment.

But even if US manufacturing was in poor health, Cass’s prescription of increased tariffs is an odd elixir. As with many US industries, imported inputs play an important role in allowing manufacturers to keep costs down and stay competitive. Raising tariffs, and thus the cost of inputs purchased from abroad will only undermine the ability of US manufacturers to compete in the global marketplace.

After all, we’ve been down this road before. In 2020 economists Kadee Russ and Lydia Cox calculated that the increased cost of steel and aluminum—an important input for numerous manufacturers including automakers and machinery producers—due to tariffs imposed by President Trump led to approximately 75,000 fewer jobs in manufacturing. Notably, that figure does not count additional losses suffered by US exporters resulting from retaliatory tariffs imposed by other countries on US exports.

Despite such public policy missteps, the United States continues to enjoy a thriving, dynamic manufacturing sector. The threat that the country’s manufacturers should be on guard against is not imports, unbalanced trade, or other alleged bugaboos but quack cures being peddled to relieve American industry of non‐existent or exaggerated ills.