Krit Chanwong

Disproportionate share hospitals (DSH) serve a disproportionate share of Medicaid and uninsured patients. The federal government requires states to provide DSHs with payments on top of what these hospitals get for treating low‐income patients. The rationale for these DSH payments is that they keep hospitals with a high proportion of nonpaying/inadequately paying patients from closing. In fiscal year (FY) 2021, federal and state supplemental payments to DSH facilities totaled $16.9 billion, or 2.3 percent, of all Medicaid expenses. The federal government covered 64% of these expenses.

The federal government’s design of the DSH program is outdated and leaves ample room for fraud. To alleviate this, the federal government should recalculate state‐level DSH allocations, limit states’ usage of abusive hospital/provider taxes, and crack down on existing hospital/provider tax loopholes.

The 1980s Tax Loophole and Current‐Day Policy Implications

Current‐day DSH funding allocations are based on the degree to which states exploited a federal financing loophole in the late 1980s‐early 1990s. As such, they are incompatible with modern healthcare realities.

From 1965–1981, states paid Medicaid providers the same prices they paid Medicare. However, in 1981, Congress eliminated this requirement in an attempt to reduce Medicaid expenses. States were now given the flexibility to experiment with cost‐containing policies, like enrollment in managed care plans (we now know that these cost‐containing experiments were failures). However, some legislators thought that lowering Medicaid payment rates might negatively affect the financial health of DSHs. To remedy this, Congress also asked states to consider additional payments to such hospitals.

In the early 1980s, states disregarded this suggestion and did not make any DSH payments. To remedy this situation, Congress tried to boost DSH payments in 1986 by removing federal reimbursement caps. States could spend unlimited amounts on DSH payments and still get federal reimbursements. This change did not increase DSH payments. So, in 1987 Congress simply required all states to provide DSH payments. To maintain financing flexibility, the federal agency that administers Medicaid (whose name is now the Center for Medicare and Medicaid Services, or CMS) issued a 1987 guidance that allowed states to raise taxes on hospitals and counties to fund Medicaid.

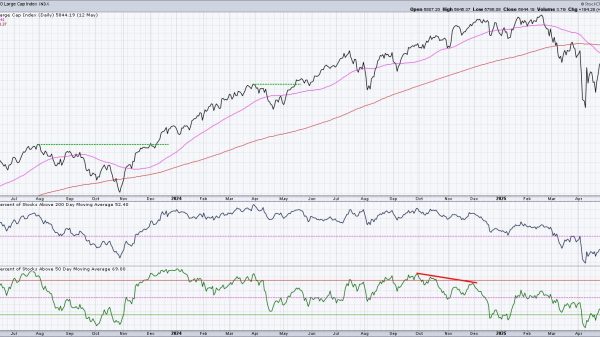

States soon found a way, illustrated in Fig. 1, to use hospital/county taxes to obtain more federal funds. And since there was no limit to DSH payments, states used the DSH program as a loophole to scam the federal government of millions of dollars. This resulted in a rise in hospital/county taxes being used to fund a state’s Medicaid share, as seen in Fig. 2. This also increased federal DSH spending from $1.4 billion in 1990 to $17.5 billion in 1992—a 1,150 percent increase.

In 1993, Congress decided to buck this explosive trend by specifying that DSH payments to hospitals cannot exceed the expenses of uncompensated Medicaid and uninsured care. The federal government also imposed tighter restrictions on the usage of hospital/provider taxes. These reforms led to federal DSH spending decreasing 5 percent from $17.5 billion in 1992 to $16.6 billion in 1993. However, the federal government did not change state‐level DSH allotments, which were maintained at 1992 levels. This policy continues to this day. As Fig. 3 shows, there is a reasonably strong correlation (ρ = 0.63) between the amount of hospital/county taxes used to fund a state’s Medicaid share in 1993 and 2021 DSH allotment per Medicaid beneficiary.

This obsolete allocation mechanism means that state‐level DSH allocations do not reflect states’ costs of uncompensated care for low‐income patients. This is why the Medicaid and CHIP Access and Payment Commission (MACPAC) has repeatedly concluded that current DSH funding levels “bear little relationship to objective measures of need.” Healthcare economist Brian Blase, in a 2019 briefing paper, also found:

The correlations between the percentage of uncompensated care provided by state hospitals [the main provider of uncompensated care] and federal DSH funding per uninsured (ρ = ‑0.31) and federal DSH funding per low‐income individual (ρ =-0.16) are both negative. This means that less federal DSH funding is going to states with higher rates of uncompensated care, further evidence that the allocations across states are illogical.

Hospital‐level DSH allocations also bear little relationship to a hospital’s financial health. For example, in FY2017, St Vincent Hospital & Health Care in Indiana had a net revenue of $268 million. It also received $26 million in DSH payments, amounting to 2% of its total revenue for that year. Another example is OhioHealth Corporation Grant Riverside, which in FY2018 had a net revenue of $527 million. Yet, in FY2018 this hospital system also received $43 million in DSH payments, or 1 percent of its total revenue for that fiscal year. Neither payment was necessary for the continued financial viability of both hospital systems. As such, these subsidies reduce the funds available to support DSHs who are struggling financially.

Possible Reforms

Congress needs to reform the DSH program to minimize waste and fraud. They have three policy options to achieve this aim:

Congress should start by recalculating state‐level allocations. Specifically, Congress should solely link DSH funding levels with the amount of uncompensated Medicaid and uninsured care. This reform would ensure that more DSH funds are going to states that need them. Current federal legislation specifies that states must use their general funds to finance at least 40 percent of their nonfederal Medicaid share. This means that states could use hospital/provider taxes to finance (at most) 60 percent of their nonfederal Medicaid share. Congress should increase this general revenue threshold to 100 percent. This would ensure that states pay for the care they receive and do not abuse federal matching rules. Current federal laws allow states to ensure hospitals receive full or partial reimbursement of taxes if the tax amount is below 6 percent of net patient revenue. A 2021 MACPAC analysis found that 32 states levied hospital/provider taxes that were between 5.5–6 percent of total net patient revenue. This shows that states are still taking advantage of the 6 percent loophole to convince hospitals to pay taxes and thus obtain more federal funds. Congress should eliminate this loophole.These proposed policy changes would ensure that the DSH program becomes more effective at helping financially struggling hospitals. Moreover, these (modest) proposals would also produce substantial cost savings: the Committee for a Responsible Federal Budget estimates that the latter two policy changes could produce $1.4 trillion in savings over ten years. In times of exploding federal deficits and deteriorating fiscal health, such policies may be financially prudent.

Ultimately, Medicaid needs to be turned into a block‐grant program. According to my colleague Michael F. Cannon, block‐granting Medicaid would “eliminate the perverse incentives that induce dependence, favor Medicaid and CHIP spending over other priorities, lead states to tolerate widespread fraud, and encourage states themselves to defraud federal taxpayers.”