Fibonacci Stock News

I begin each year by reviewing the long-term technical positions and behaviors of the “Big Four” — 10-year yields, S&P 500 ($SPX), Commodities, and...

Hi, what are you looking for?

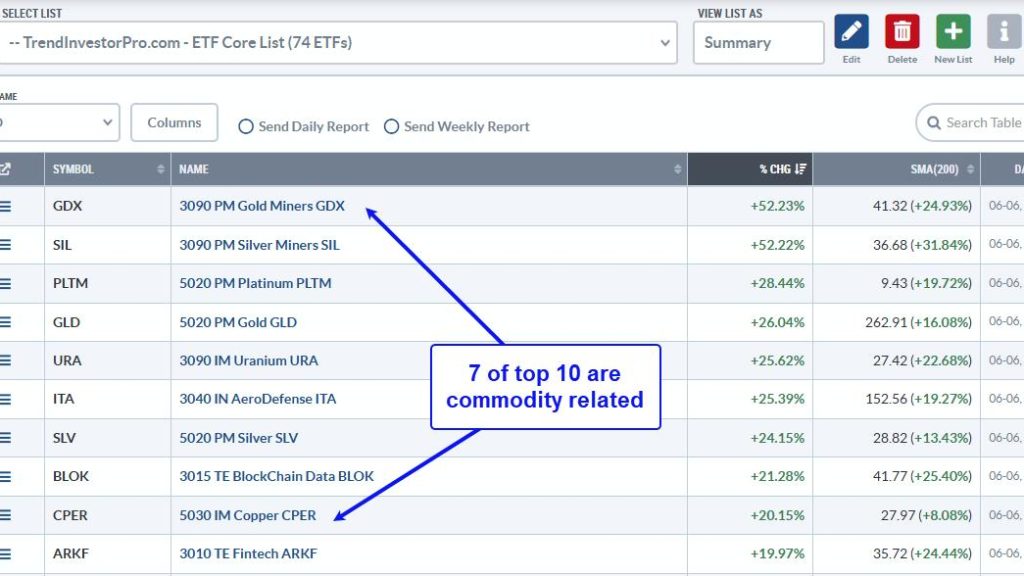

QQQ and tech ETFs are leading the surge off the April low, but there is another group leading year-to-date. Year-to-date performance is important because...

After consolidating for two weeks, the Nifty finally appeared to be flexing its muscles for a potential move higher. Over the past five sessions,...

Stay ahead of the market in under 30 minutes! In this video, Mary Ellen breaks down why the S&P 500 just broke out, which...

This week, we got a smorgasbord of jobs data — JOLTS, ADP, weekly jobless claims, and the nonfarm payrolls (NFP). Friday’s NFP, the big...

Michael F. Cannon President Trump and Senate Republicans will consider measures to eliminate waste, fraud, and abuse in Medicare. Along with Medicaid, Medicare is...

I begin each year by reviewing the long-term technical positions and behaviors of the “Big Four” — 10-year yields, S&P 500 ($SPX), Commodities, and...

In this edition of StockCharts TV‘s The Final Bar, Dave focuses on AAPL which closed below its 200-day moving average as it tests key...

On this episode of StockCharts TV’s Sector Spotlight, I separate the 11 sectors in the S&P 500 into Offensive, Defensive, and Sensitive, assessing their...

BETAOne of the Risk ON/OFF metrics I like to keep an eye on is BETA.From Investopedia:Beta (β) is a measure of the volatility—or systematic...

We’re one day away from “DRAFT Day”! Every quarter, we select the 10 equal-weighted stocks that will comprise our 3 portfolios – Model, Aggressive,...

The momentum phenomenon has been a fixture in the US equity markets for decades. There are two types of momentum to consider: absolute momentum...

A Buying Climax typically concludes a long term uptrend. The rally phase from the October low of 2023 has these climactic characteristics. This advance...

Some serious consolidation continued in the markets as the Nifty oscillated in a defined range before closing the week with modest gains. Examination of...

While many analysts follow sentiment signals that involve feelings about market direction, I prefer one that follows the MONEY. I want to know what...

The masses have been confounded by the strength of this current secular bull market. Too many keep betting against it and they’ve cost themselves...