Fibonacci Stock News

The Health Care sector started rallying in early November 2023, at about the same time the S&P 500 ($SPX) rallied. The AI buzz may...

Hi, what are you looking for?

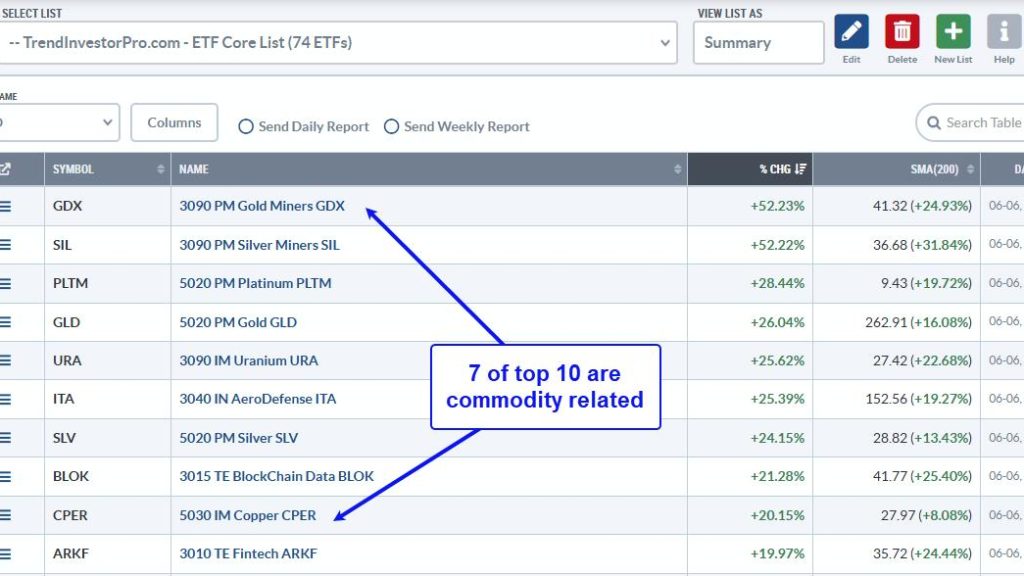

QQQ and tech ETFs are leading the surge off the April low, but there is another group leading year-to-date. Year-to-date performance is important because...

After consolidating for two weeks, the Nifty finally appeared to be flexing its muscles for a potential move higher. Over the past five sessions,...

Stay ahead of the market in under 30 minutes! In this video, Mary Ellen breaks down why the S&P 500 just broke out, which...

This week, we got a smorgasbord of jobs data — JOLTS, ADP, weekly jobless claims, and the nonfarm payrolls (NFP). Friday’s NFP, the big...

Michael F. Cannon President Trump and Senate Republicans will consider measures to eliminate waste, fraud, and abuse in Medicare. Along with Medicaid, Medicare is...

The Health Care sector started rallying in early November 2023, at about the same time the S&P 500 ($SPX) rallied. The AI buzz may...

Uncertainty needs attention in order for it to make you second guess yourself. Instead, wait for trends to change, and then make changes. On...

In this edition of StockCharts TV‘s The Final Bar, Julius de Kempenaer of RRG Research talks stocks over bonds and highlights two sectors with...

As a main aluminum producer, Alcoa (AA) announced cost-cutting measures, along with plans to curtail production at one Western Australian Refinery. But that is...

Important days for stocks usually are associated with big volume, major support/resistance, and a test of leadership. As I look at Upwork, Inc. (UPWK),...

In this edition of StockCharts TV‘s The Final Bar, Grayson Roze and Dave break down the trends for the top ten stocks and ETF...

Starting with the Jeffries Group on January 9th, by Friday, we will see Bank of America (BAC), JP Morgan (JPM), Wells Fargo (WFC), and...

Note to the reader: This is the fourth in a series of articles I’m publishing here taken from my book, “Investing with the Trend.”...

Mean-reversion strategies typically buy stocks when they are oversold, which means catching the falling knife. These declines are often rather sharp, but the odds...

Tech stocks were hit with selling pressure to start the year, but many are still in long-term trends and some are nearing support-reversal zones....