Fibonacci Stock News

The stock market is off to a great start on the first trading day of December. The S&P 500 ($SPX) closed at its 2023...

Hi, what are you looking for?

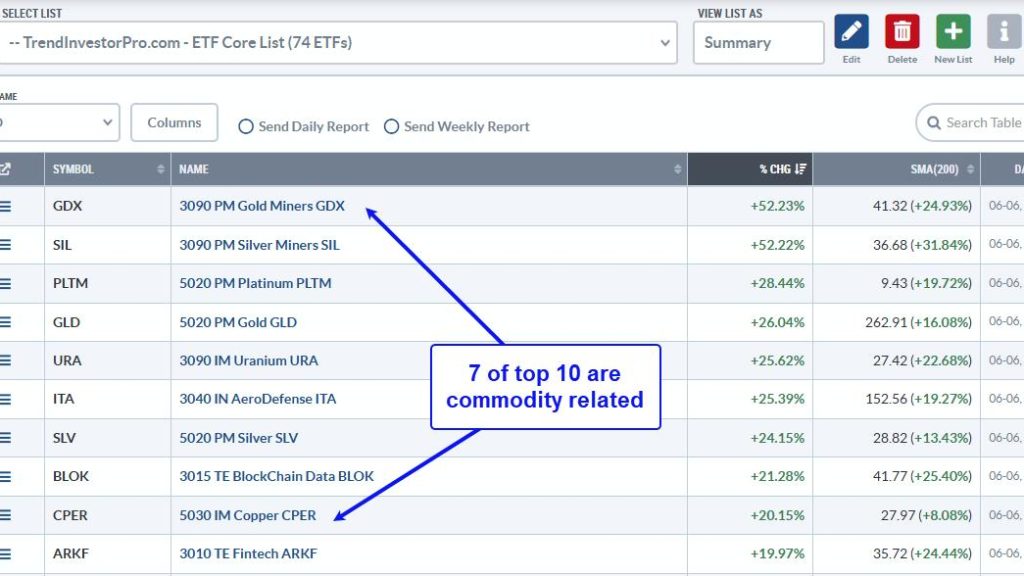

QQQ and tech ETFs are leading the surge off the April low, but there is another group leading year-to-date. Year-to-date performance is important because...

After consolidating for two weeks, the Nifty finally appeared to be flexing its muscles for a potential move higher. Over the past five sessions,...

Stay ahead of the market in under 30 minutes! In this video, Mary Ellen breaks down why the S&P 500 just broke out, which...

This week, we got a smorgasbord of jobs data — JOLTS, ADP, weekly jobless claims, and the nonfarm payrolls (NFP). Friday’s NFP, the big...

Michael F. Cannon President Trump and Senate Republicans will consider measures to eliminate waste, fraud, and abuse in Medicare. Along with Medicaid, Medicare is...

The stock market is off to a great start on the first trading day of December. The S&P 500 ($SPX) closed at its 2023...

I think Friday’s session was telling, in that the S&P 500 finished the week up about 1% while the Nasdaq 100 was nearly flat....

In this episode of StockCharts TV‘s The MEM Edge, Mary Ellen reviews the outperformance that took place amid a declining rate environment, while also...

In this week’s edition of Moxie Indicator Minutes, TG notes that the market is finally letting some steam out which is what we want...

I’m not an investment arsonist! I won’t try to convince you that stock market perfection is achievable. I will, however, guarantee (strong word) that...

Last week, in my Weekly Market Report to EarningsBeats.com members, I pointed out the upcoming bullish history of the small cap Russell 2000 Index...

While December 1st brought out the bulls in nearly EVERYTHING, one area caught our attention.In December 2019, I saw a similar chart showing an...

Snap Inc.’s stock (SNAP) price exceeded its upper Bollinger Band. But what does this mean for the stock’s price move?To start, a move above...

Despite the total cuts by all countries added at the November 30th OPEC+ meeting, oil sold off, testing key support. Countries like Angola have...

There is a weird phenomenon that has cropped up in the options markets over the past couple of years. Even weirder is that this...